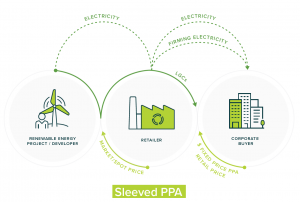

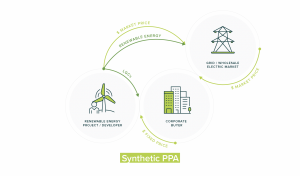

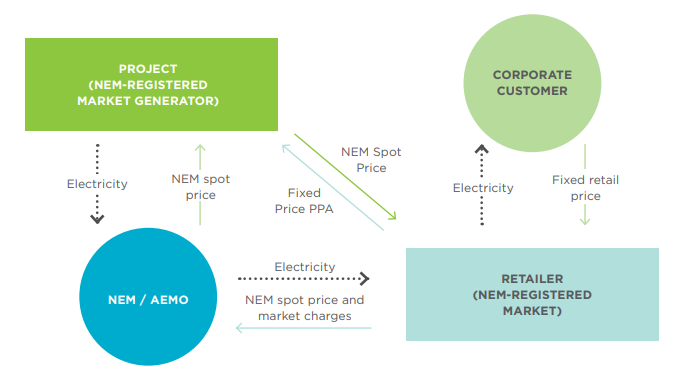

A PPA is a contract between a buyer and generator to purchase (whether physically or notionally) electricity at a pre-agreed price for a pre-agreed period of time. In the context of the National Electricity Market (NEM), which is a pooled wholesale market for the supply of electricity across Australia (excluding Western Australia and the Northern Territory), a retail licence is required to trade in electricity. In the absence of a “Corporate PPA”, typically energy is acquired, hedged and retailed as follows:

As an alternative to the above, a corporate can instead choose to take the control over its energy hedging and retail arrangements (and supply of green rights) by

contracting either directly or indirectly with a renewable

energy generator. This is known as a “Corporate PPA”, that is, a PPA between a generator and the end

corporate customer (either directly or indirectly through a licensed retailer).

In practice, a Corporate PPA can be viewed as an electricity pricing “control tool” or a “green hedge” and can take a number of different forms, ranging from a physical transfer of power to a pure financial derivatives contract. In an era of energy uncertainty, and rising prices for both electricity and renewable energy certificates, a Corporate PPA offers the opportunity to hedge and thereby manage long term pricing risk.

Key drivers for a Corporate PPA

Corporate PPAs are becoming more popular both globally and domestically, as corporates become increasingly interested in actively managing their

electricity procurement costs in the face of volatile and / or rising power prices and in investing in the renewable energy industry (see Figure 1 that illustrates,

by way of example, the electricity price increases faced by manufacturing businesses in South Australia). Corporate PPAs provide the corporate with visibility

over, and therefore the ability to control:

a) Their exposure to electricity wholesale costs

b) The wholesale cost of large-scale generation

certificates (LGCs) or other green rights.

By entering into long term hedging or supply arrangements with the generators, the corporate is

well positioned to reduce these costs.