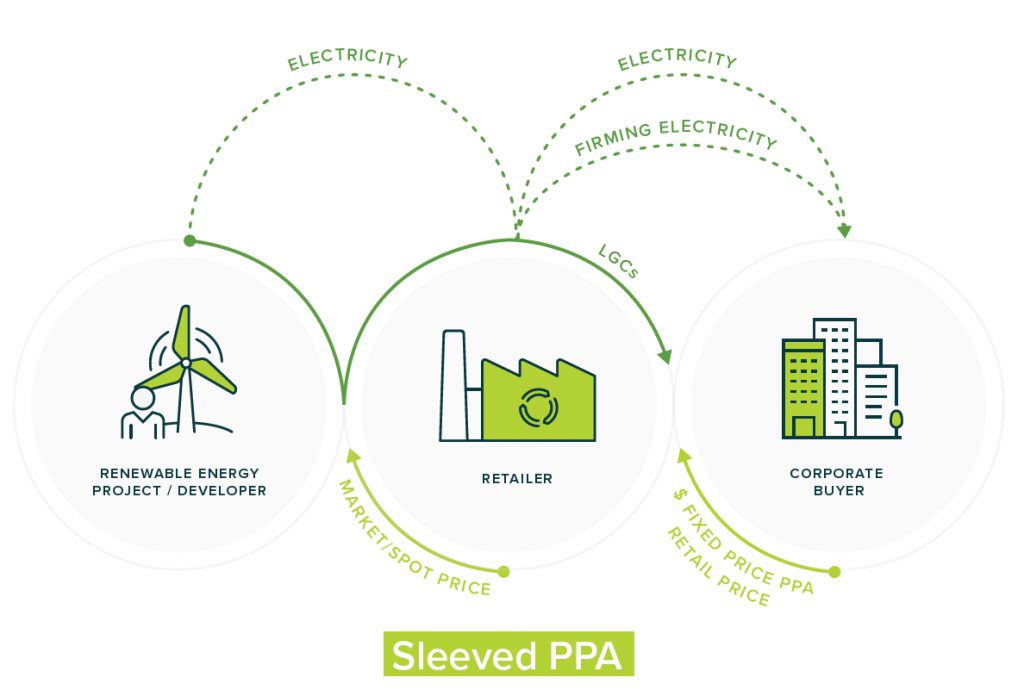

This model contemplates a retailer driving the contractual arrangements. The project owner and retailer enter into a CfD for electricity and LGCs generated by the project. In return for paying a fixed price calculated on the basis of the project’s output, the retailer receives the spot price calculated on the basis of the project’s output. The retailer enters into a retail contract with a corporate that mirrors the same term of the CfD. The corporate may pay the retailer a “Bundled PPA price” (a price that includes both an electricity tariff component and an LGC price component) or a market-based tariff, depending on the corporate’s preference for price certainty. The retailer receives LGCs from the project to cover the corporate’s LGC liability (although the retailer will likely charge a fee for this). The corporate may be required to provide credit support to the project. Variations include pooling corporate customers whose load is aggregated or contracting with a vertically integrated retailer who is also the renewable energy developer.